Historic Vote!

The U.S. House of Representatives overwhelmingly passed a historic bill Wednesday providing legalized cannabis businesses access to banking services.

Colorado Congressman Ed Perlmutter, lead sponsor of the SAFE Banking Act, said:

“After six years of working on this bill, the SAFE Banking Act will go a long way in getting cash off our streets and providing certainty so financial institutions can work with cannabis businesses and employees.”

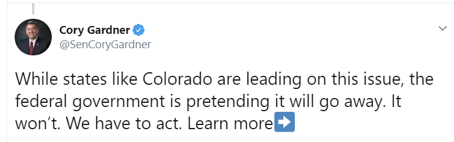

It’s still an uphill climb in the U.S. Senate, but Senate Republicans may be softening. U.S. Sen. Marco Rubio, R-Fla., said Wednesday:

“I think you can be against marijuana and still understand that if it’s going to be a legalized product, we need to be able to control it through our banking system.”

And the chairman of the Senate Banking Committee Mike Crapo, R-Idaho, has said he wants to advance banking legislation by the end of the year, although it may not be Perlmutter’s bill.

Bipartisan Group of 21 AG’s Implore Congress to Act

Colorado Attorney General Phil Weiser and 20 other attorneys general signed a letter sent to congressional leaders on Monday, supporting the STATES Act, which would allow legal cannabis businesses to access banks, shield legal cannabis businesses from federal interference and deter criminal activity associated with a largely cash-only business.

“We are a bipartisan group of state and territorial attorneys general who share a strong interest in defending states’ rights, protecting public safety, improving our criminal justice systems, and regulating new industries appropriately,” the letter reads. “Legislation like the proposed STATES Act is simply meant to ensure that if a state or territory does choose to legalize some form of marijuana use – which at least 33 states and several territories have done – its residents are not subject to a confusing and dangerous regulatory limbo.”

The House

The House

Cannabis industry slowly wooing banks

Cannabis industry slowly wooing banks State expands cannabis education campaign

State expands cannabis education campaign ‘Cannabis girl’ fights to operate cannabis gym

‘Cannabis girl’ fights to operate cannabis gym